Above asking price trend reaches new highs as insatiable homebuyer appetite continues and sellers ask, “what’s a buyer willing to pay?”

ENGLEWOOD, CO – May

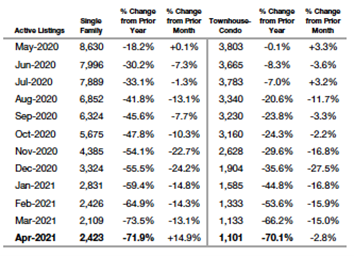

12, 2021 – Despite the first month-over-month increase in the inventory of

active listings in nearly a year, an insatiable homebuyer appetite quickly

offset those gains with increases in the number of properties under contract

and closed in April, according to the latest data from the Colorado Association

of REALTORS® (CAR).

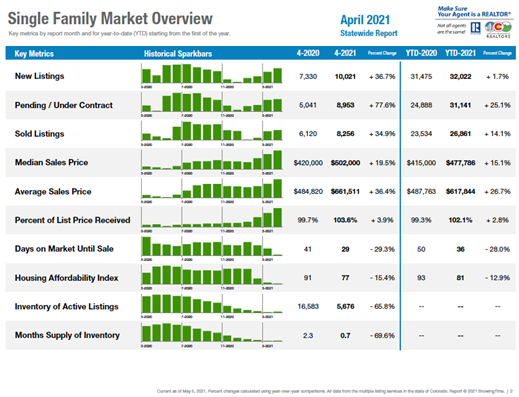

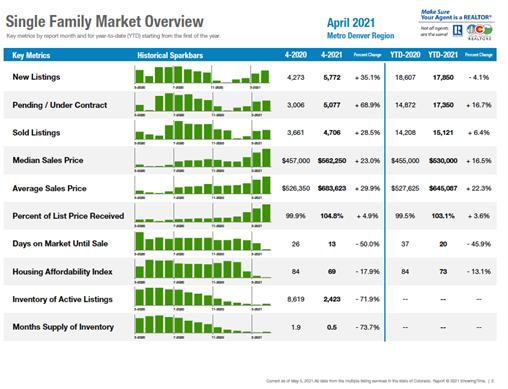

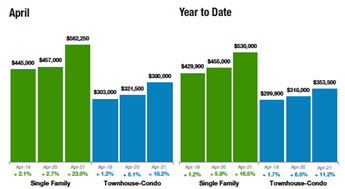

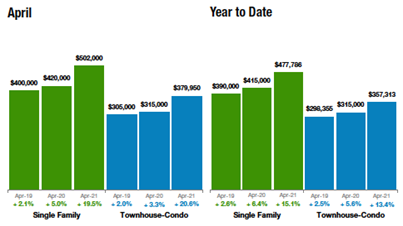

Market conditions

continue to drive pricing for all property types in the Denver-metro area and

across the state to new record highs with the median price of a single-family

home in Colorado topping $500,000 for the first time, a price point that has

doubled in just over 7 years. Whether you’re looking in the Denver-metro area

or any other market across the state, the median condo/townhome price has risen

approximately 20% year-over-year to a record $380,000, while the Denver-area

single-family home hit a median price record of $562,250 in April.

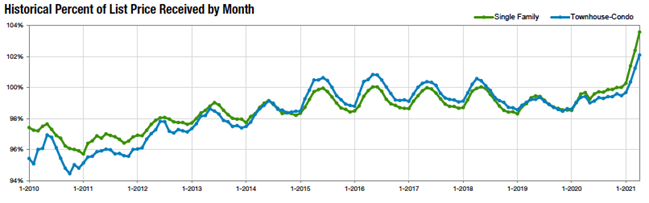

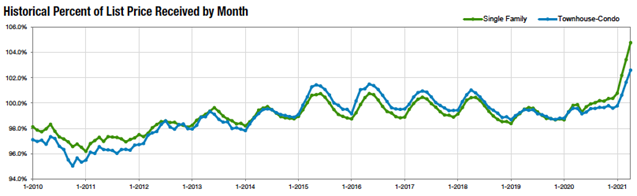

“In April, the average freestanding home in

Denver sold for its highest percentage above asking price than ever before. The

last three months, in fact, have broken records month-over-month with the

average home in April selling for 105.5% of asking price,” said Denver-Area

REALTOR® Matthew Leprino. The above-asking price trend, prevalent

across the state in recent months, continued through April with record highs

also set across all property types and markets. In the Denver-metro area, the

percent of list price received came in just shy of 105% for single-family homes

and 102.6%for condo/townhomes. Statewide, the numbers showed 103.6% for

single-family and 102.1% for condo/townhomes. “Officially, sales price/list price comes in at 104%, but

REALTORS® will explain their experience is closer to 10% over list

price in the moderate price ranges,” said Boulder/Broomfield area REALTOR®, Kelly Moye.

For some, this furious market is raising

questions about a bubble and the potential for a painful crash. Last week, Google

reported that the search “When is the housing market going to crash?” had

spiked 2,450% in the past month. The answer we’re seeing from economists:

There’s no comparison.

“Many industry experts believe there is no

bubble; instead, the demand for housing in the west, particularly in resort

areas, is higher than ever due to the migration of people leaving big cities,”

said Durango-Area REALTOR® Jarrod Nixon.

The struggle for

prospective homebuyers doesn’t end with inventory as rising prices continue to

negatively impact affordability. The CAR Housing Affordability Index, a measure

of how affordable a region’s housing is for consumers based on interest rates,

median sales price and median income by county, is down between 15-18% for all

property types statewide from a year ago.

REALTORS® continue to look at

the market and wonder is there a break? Will we ever see a slowdown? Will

affordable housing be something we see again?

“Builders cannot

break ground fast enough, so no reprieve there. Interest rates remain low, so

that continues to push prices and buying. For the short term, there is no calm

in site. It’s a real estate storm and buying frenzy that does not appear to be

burning out soon,” said Colorado Springs-Area REALTOR® Patrick

Muldoon.

STATEWIDE REPORT

METRO DENVER REPORT

Taking a look at some of the state’s local market

conditions, Colorado Association of REALTORS®market trends spokespersons provided the following

assessments:

AURORA

“Looking to find a single-family residential home under $300,000 in

Aurora? Unfortunately, there is not one to be found. Even the median

price of an Aurora condo/townhome is now at $290,000, up 11% from April

2020. The median home price in Aurora is at $465,000, a 14.8% increase

over last year. That said, our 80019 zip code has only 14 listings available at

a median price of $512,639, up 12% over 2020. The 80015 zip code is now at

a median price of $500,000, up 18.3% over last year while 80011, which

encompasses original Aurora, now has a median price $401,000, a 19.7% increase.

If you are looking in this area, understand that there are only 10 available

listings. The Aurora condo/townhome inventory is down 76.9% over last year

with just 81 condo/townhomes available compared to 351 this time last

year.

“Centennial represents the same low inventory, down 68% over this time

last year for single- family homes and a median price of $605,000, a 17%

increase over April 2020. Townhomes/condo in Centennial show a median price of

$430,000, but you will only find seven of those types of properties available

today.

“Looking to zip code 80111, Greenwood Village and Englewood, we see a

median price of $894,000, up 30% over April 2020. Inventory is down 75%

and there are only 13 available properties. Townhome/condos in that same

zip code are up in price 86% over last April at a median price of $465,000 –

that is not a typo.

“It is important to note, that buyers are getting

homes. Occasionally, offers fall out of contract giving potential buyers

an added opportunity. Will this ever slow down? Yes, of course, the

questions we all have are, when and why? For the immediate future, we have

a housing shortage and a number of buyers looking to take advantage of low

interest rates and join the ranks of home ownership. Stay vigilant. There

is a house out there for you,” said Aurora-area REALTOR® Sunny Banka.

BOUDER/BROOMFIELD

“In Boulder and Broomfield

counties, we haven’t seen numbers like this, well……ever. Heading into the

summer, Boulder County single-family homes have already experienced 28%

appreciation, and we’re not even at the end of the summer when we typically see

our biggest jump in prices for the year. ‘If you can’t be with the one you

love, love the one you’re with,’ must be playing in homeowner’s heads as they

discover it’s too expensive to move to suit their needs, so they end up staying

where they are and making home improvements. This lack of fluid mobility

in the market has kept inventory so low that the increased demand continues to

push prices up.

“Officially,

sales price/list price comes in at 104%, but REALTORS® will

explain their experience is closer to 10% over list price in the moderate price

ranges. Boulder’s neighbor, Broomfield, also puts up big numbers for the year

with single-family homes up 16% and condos/townhomes keeping up at 15% so far

for the year.

“The only soft

spot here are condos and townhomes in Boulder. They have had a modest 4% appreciation

and listings are up 4.7%. It is likely that the owners of these smaller

properties in a more dense environment are moving to more space for work and

play, leaving the Boulder condo market much softer than its single-family

counterpart.

“Most

professionals agree that this market is not sustainable. The question is, when

will it end and what will happen to initiate it? This is not a market bubble

that will burst but instead, it is likely the lack of affordability that will

eventually affect the demand and the market will slow down and balance out,” said Boulder/Broomfield-area

REALTOR® Kelly Moye.

BROOMFIELD/I-76 CORRIDOR

“With the ability to work from home and

the population increase in Denver suburbs, we are seeing an increase of people

migrating out to the I-76 corridor. This area provides the ability to buy more home

for the money the farther east you go. Sellers in this area are experiencing a

great return on their real estate investment. From a year ago the average home

sells prices have increased in Adams County by 13.5%, Weld County by 16.2%,

Morgan County by 19.7%, and Washington County by 15%. With many people on the

move, the stats are showing that it is a great time for homeowners along the

I-76 corridor to list their homes and cash in on this market,” said Broomfield-area

REALTOR® Jody Malone.

COLORADO SPRINGS/PIKES PEAK AREA

“Real estate has been

a very interesting thing to follow for the last year. In one of the most

trying times in our history, where an entire world economy was closed down,

real estate brushed it off, hit they gym, and grew in strength. A year ago,

we were trying to determine whether or not we were going to be actively selling

at all. REALTORS® statewide were back and forth on new rules, regulations,

and safety precautions. Looking back now it seems we pulled off the impossible.

We continued to represent buyers and sellers safely and pushed through one of

the hardest markets we have ever seen. And this shows in our stats locally. We

are up 21% on all properties sold year-over-year. The housing market pushed up

19% on the medium price range and sadly, active properties dropped 56%.

“Is there a

break? Will we ever see a slowdown? Will affordable housing be something

we see again? It’s hard to say. Institutional investors are offering obscene

amounts of money to gobble up homes and beat many individual homeowners out on

purchases. One in five reported sales nationwide are going to institutional

investors. And this isn’t just an American problem. Canada and other countries

are also seeing these large corporations grabbing up inventory and turning

those homes into rentals. Builders cannot break ground fast enough, so no

reprieve there. Interest rates remain low, so that continues to push prices and

buying. For the short term, there is no calm in site. It’s a real estate storm

and buying frenzy that does not appear to be burning out soon.

“Economic numbers

remain terrible nationally, the stimulus money the FED prints is leading to

inflation, and the world continues to battle with COVID-19. Real estate remains

a safe haven for money. As long as supply remains low and demand is high,

housing market trajectory is heading north,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“Today’s buyer has

fundamentally shifted their methods and the effects are beginning to ripple

through your neighborhood. While

each transaction brings new tales of what worked and what didn’t, today’s consumer and

yes, their REALTOR® are tasked with finding newer, more creative

methods of standing out from the rest. Long ago, the ‘love letter’ was the way

to romance a seller into accepting your offer – no more. Today, the love letter comes in the form of a larger overall

check and, in most cases, paying significantly more than a house may be

worth at that snapshot in time. We REALTORS® have and hopefully

will always continue to advise against the practice but the fact of the matter

is that if you want a home, you will likely need to show a seller just how much

you want it. While the practice of paying more than a house is worth is

certainly risky, the changing tides prove that that risk, in some

circumstances, is short lived. Take for instance someone who offers to pay

$20,000 more than a house is worth – and their offer gets accepted. That home

then closes and the neighbor down the road now lists their home $5,000 higher

than that. Not only has every other neighbor now appreciated in price by

$25,000 but the homebuyer who paid $20,000 more than asking has gone from $20K

in the hole to $5K in the black.

“Because of these

practices, the latest data from the Colorado Association of REALTORS®

shows that in April, the average freestanding home in Denver sold for its

highest percentage above asking price than ever before. The last three

months, in fact, have broken records month-over-month with the average home in

April selling for 105.5% of asking price. The only time other than the last

three months that the average went above 101% was during May 2016 and that

number quickly fell back to the 100% just two months later and even below

asking just a month after that. A direct reflection of the multiple offers and

bidding above asking-saga we see today, buyers are looking at lower budgets as

their opening bid as the asking price in today’s market is merely the reserve

price and not entirely an indication of ending value,” said Denver-area

REALTOR® Matthew

Leprino.

DURANGO/LA PLATA COUNTY

“What is this house

worth? That is the question all buyers and sellers are asking in today’s

market. The answer is: what a buyer is willing to pay. La Plata County

continues to see significant increases in both average sales price and number

of units sold. The average sales price for a single-family home in 2020 was

$565,678 compared to $704,112 in 2021, a 24.5% increase. Units sold are also up

more than 24%. Prices are being driven by the complete scarcity of available

product and low interest rates. Inventory of homes for sale dropped over 70%

compared to April 2020 for single-family homes and more than 85% for townhomes

and condos.

“Bidding wars are the new

normal, with most new listings going under contract within days of hitting the

market. As a result of sellers not wanting to endure the stress of multiple

offers and countless showings, many homes are being sold off-market and never

hit the open market. It is not unusual for a home to sell for tens of thousands

over the asking price. Many buyers are using escalation clauses and few (if

any) contingencies in their offers.

“The perception is that sellers

are reaping all the benefits of this hot market, but unless they are leaving

the area, sellers are finding themselves in the same shoes as their buyers when

trying to find a suitable replacement property. The true winners are the

second homeowners and investors that can sell today and wait for the market to

cool down.

“There is talk of a housing

bubble in our market. Many industry experts believe there is no bubble;

instead, the demand for housing in the west, particularly in resort areas, is

higher than ever due to the migration of people leaving big cities. Many locals

believe Durango has been undervalued for decades compared to other resort

markets in Colorado. Buyers, taking advantage of continued low interest rates

and increased options for working remotely, are choosing Durango for its

natural beauty and endless outdoor offerings. The forecast for the market is

more of the same for the foreseeable future,” said

Durango-area REALTOR® Jarrod

Nixon.

ESTES PARK

“The highs and

lows that our clients are feeling right now are comparable to the dramatic

weather we are experiencing. Hot and cold, with a chance of rain, snow or

lightning. What will they experience? Cold returns on offer after offer that

are outbid? Heat when they are feeling the pressure to buy, but can’t find

anything in their price range? The constant conversation about the inventory

and where the next new listing may pop us is definitely a strike of lightning

in the atmosphere. Where will the hot spot be? If only we had some sort of

crystal ball to tell the future.

“In Larimer

County, new listings are slowly arriving on the market, but only at a drizzle

with year-to-date single-family homes down 7.6% compared to 2021. However, in

the month of April, new listings exceeded April 2020 by 25.3%. Is that spring

we are feeling in the air? Townhouse/condos are electrifying the market with

52.6% more listings this past month compared to April 2020, and year-to-date

they have increased 10.7%.

Homes are selling

almost as fast as they can be placed on the MLS. Days on market for single-family

homes has been slashed to 42 days compared to 70 in April last year, a drop of

40%. Year-to-date days on market has also dropped 72 to 54, a 25% decrease

in time. Townhouse/condos have again taken the lead with a whopping cut in days

on market to 42 from 108, 61.1% less compared to April last year. Year-to-date townhouse/condos

have been on the market 45 days less, a 42% decrease. As of August 2020, the

average time from offer to close was 45 days (per Ellie Mae).

“The ‘climate’

out there is causing a clamor for the best value for the money, and fast, but

this is also driving prices up at a feverish pace. The average sales price for

a single-family home in Larimer County reached $543,754 in April, an 8.5% bump

from April last year. Year-to-date, the average sales price climbed 12.3%. The

percent of list price received, 103% for single-family in April, is directly affected

by the short inventory and climbing prices. Townhouse/condos have been

experiencing the same with the average sales price up 13.9% in April to

$361,864. Percent of list price received has also gone over asking at 101.8%, a

2.1% increase from April 2020.

“Larimer County

is currently running with almost no supply of inventory. In April, the months

supply of single- family homes fell from 2.4 months to only 0.6. Townhouse/condos

had an even larger dip in inventory from 3 months to 0.6, an 80% decrease.

“As we go from

hot to cold with rain, lightning and ice, this is no different from the climate

in the real estate market,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“Compound Appreciation. Most

of us are familiar with the term Compound

Interest. It is one of the single greatest wealth-building concepts

of economics. The short version of this concept is that if you invest a

principal sum (let’s say $10,000) in an interest-bearing account, stock,

annuity, or commodity of some sort, the interest earned on that investment

compounds on a set interval (let’s say monthly at 5%). The original $10k

after one month of investment time at that growth rate is now worth

$10,500. The investor has made $500 by doing nothing but leaving the

principal in the investment portfolio. In the second month, the interest is now

calculated on the new principal amount of $10,500 and earns $525. Total

value in two months is now $11,025. When you parse out the compound

interest calculation over the course of a year, the original 10,000 after 12

months is now worth over $18,000. The gains (if consistent) are

exponential.

“The same kind of thing is happening in the real estate market, except

it is more like Compound

Appreciation. The combination of constrained inventory and high demand

leads to competitive offers on homes for sale. The competitive offers on

homes for sale leads to a purchase for over the asking price. As long as

the buyer consummates that purchase, the sale price for that home now becomes a

statistical comparable for similar homes for sale in the same market. The

cycle continues and we see double-digit appreciation on homes compared to what

the relative value was at the beginning of the year. Is this leapfrog in

valuation sustainable? Probably not – but until demand abates, prices are

likely to continue to climb.

“With median prices in Fort Collins for April sales pegged at

$510,000, affordability is at a decade long low. With the average

sales price of homes 3.4% over the asking price, Buyers are leveraging all

their discretionary cash in the hopes that the home will appraise for close to

the over-asking purchase price. In some cases, buyers are bringing tens of

thousands of dollars to closing, in addition to a traditional down-payment of

5-20% of the purchase price. There are no signs of the demand for homes

lessening any time soon. The average days to offer for homes listed on the

market after March 1 is a grand total of four. Homes are being snapped up as

quickly as they are being listed. New listings increased 24% year-over-year

which is a great number but nearly every single house that came on is now sold.

If nothing else came on the market in the next 3 weeks, everything currently

for sale would be sold.

“This isn’t just a tale about sub-median priced homes. All segments

of the market in northern Larimer County are seeing high demand and exponential

growth in sales. Sales of homes between $1 million and $2 million have

doubled year over year. Homes sold between $500k and $699k are up 71%

compared to the same time frame last year. Yes, the COVID-19 shutdown of

the real estate market is playing a role in making some of the housing data a

bit noisy – but the sheer number of sales in those high-end price points

remains stunning. The shifts of home buyers from detached homes to condos

and townhomes continues as sales in the $400k

range for townhomes/condos have more than tripled in the last 12 months.

“The momentum of this market appears to be full-steam ahead. Only time

will tell as the summer months near to see if the pent-up drive to purchase a

home will take a back seat to the pent-up need for family vacations in June,

July, and August,” said Fort

Collins-area REALTOR® Chris Hardy.

FREMONT/CUSTER COUNTIES

“We are continuing the frenzy here in Fremont and Custer counties. Every month, the new listings come in less than last year and there are more new sales. We are seeing more vacant lots selling than in our typical market and mountain property prices are rising and selling quickly. Our vacant mountain property inventory has seen a significant reduction in numbers in the last year.

“We are seeing buyers trying to negotiate with sellers before the property goes on the market, trying to get an edge. The ‘we will buy your home,’ postcards are out in force, looking for ‘uneducated’ sellers. It is a seller’s market, but sellers beware, the market changes on a daily basis,” said Fremont and Custer County-area REALTOR® David Madone.

Custer County by the Numbers:

Median price of $425,000 is up 53.2% year-over-year

Average price of

$476,824 is up 49.7% year-over-year

New listings are

down 1.3%

Sales are up

36.2%.

There is 2.3

months supply of inventory

GOLDEN/ARVADA – JEFFERSON COUNTY

“New listings in Jefferson County are up 50% from this time last year

despite the fact that this past month had one of the lowest volumes of

inventory on record, down 67% from a year prior. Days on market was down 50%

and our months supply of inventory was down 73% from this time last year. With

so little inventory, home prices continue to climb as the median price for a single-family home

hit $610,000 in April. For condo/townhomes, the median sales price reached

$340,000 with average days on market at 12.

“Buyers still need to be aggressive with their offers going over

list price and covering the difference in cash from the appraised price

and the purchase price. Homes for sale enter the market on Thursday or

Friday and are under contract on Monday. For most offers, buyers are waiving

the inspection and making their earnest money non-refundable at some point

early on in the contract process,” said

Golden/Jefferson County-area REALTOR® Barb Ecker.

GLENWOOD SPRINGS/GARFIELD COUNTY

“It looks like the

secret is out, it is a seller’s market. New single-family listings increased

23% in Garfield County over April 2020. Not surprisingly, those listings were

gobbled up in 3-4 days on market as buyers aggressively worked to outbid each

other. The frustration level for buyers is at an unprecedented high with brokers

pulling out all the stops to try to get their client into the home. Sold

listings are up 39% with the average days on market down 46% to 46 days, just

over what it takes to sell a home. The months supply in the single-family

sector fell 67% to a ghastly 1.2 months. The average sale price of a

single-family home in Garfield County topped out at a whopping $720,000, an

increase of 35% over April of last year and likely the highest average of all

time.

“Unlike some

other counties in Colorado, the townhome/condo market showed good strides as

well. New listings were up 66.7% and sold listings had an unbelievable 140%

increase. Average sale price was up 39% with 100.7% percent of list-to-sale

price. The current inventory was down almost 60% landing at 1.3 months of

inventory. The townhome market did see longer days on market compared to last

year, as the frustrated single-family buyer decided to settle into an attached

unit instead of fighting the battle. The

big question on everyone’s mind is ‘When will it end?’” said

Glenwood Springs-area REALTOR®

Erin Bassett.

PUEBLO

“The Pueblo housing market has remained

strong for sellers and builders through the month of April with buyers still

having to fight over the small number of homes for sale. April saw new listings

rise 23.1% over last year and are up 6.6% year-to-date compared to the same

period in 2020. Pending sales jumped up 56.2% over last April and sold listings

were up 19.2% over 2020 and are up 5.3% year to date.

“Median prices in April rose

to $275,000, up 18.1% from last April with the percent of list to sale price up

4% in April to 101.9%. Sitting on less than one month’s supply of homes for

sale, buyers are pushed to write contracts above listing price. This is the

second consecutive month that contract price has exceeded list price.

“With just 192 active

listings in April, we are down more than 50% over April 2020. Eighty new home

permits were issued in April bringing the Pueblo County total for the first

four months of 2021 to 268, about half of what was issues in all of 2020.

Pueblo West leads the pack with 153 permits,” said Pueblo-area REALTOR®David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Buying real

estate in many markets including Steamboat, is kind of like playing the game,

The Price is Right. Given the multiple offer scenarios, the seller is certainly

determining which buyer-contestant has the right price. The biggest disparity

is that in the game, whomever comes closest to the price without going over

wins; whereas, with current real estate conditions, if you are not bidding over

the (list) price you are likely going to lose.

“Looking back at

April, two single-family home sales over $10 million skewed the average sales

price to over $2 million with the median sales price sitting at about $1.3

million with average days on market at 35. New listings were basically the

same as the prior year however, the townhouse-condo market saw an increase of

71%, which was devoured by the insatiable buyer demand resulting in a 200%

increase in pending sales. The average sales price for multi-family was

$846,918 in April with the median $715,000 and days on market at 23 days. The

record low days on market reflects the high number of cash transactions and sellers

taking a sure thing without appraisal delays or possibilities of appraisal

objection- even though a buyer may be willing to absorb the appraisal gap.

“Active listings

for single and multi-family were a low standing inventory of 45 for each

category with a month or less supply. May and June typically bring a new

crop of listings and we look forward to those just as we look forward to the

new buds and flowers spring brings. As Edwin

Way Teale said, ‘The world’s

favorite season is the spring. All things seem possible in May.’ It is possible to buy a home in the Yampa

Valley – retain an experienced and dedicated real estate broker for your best

chances of success and while competing might be stressful, keep your eye on the

prize,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“Buyers beware. Being

a buyer in this market is competitive business. It takes a crazy mix of hurry up and

wait to find that perfect property. Buyers have to be ready to write a

seller friendly offer (statistically over list price) the moment a desirable

property hits the market. Even as they express fatigue and frustration,

there are still more buyers than sellers so, until that balances out, buyers

have to eat their Wheaties to stay strong through the process.

“With prices rising, the percent of locals buying and selling has dropped to just 18% of sales in Summit while 47% come from the front range and 35% are from out of state, mostly Texas and Florida. About 35% of the transactions were cash. The good news for buyers is that more properties sold than ever before, up 146%. So, although the active inventory was down 55%, new listings were up 84%. Summer is usually our busiest selling season, and the unknown is if we will follow previous trends. If so, there may be more to buy soon,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“April 2021 sales were

up 168% over April 2020 with buyers increasingly targeting the Mountain Village

and the rural subdivisions west of Telluride due to the amount of inventory

available in those market areas. April 2020 sales in the Mountain Village were

$8.9 million compared to this April’s $57.3 million. We are seeing more sellers moving out

of the market to locations in and out of Colorado. However, the buyer demand

has not waned. In the first four months of this year, sales are up 108% over

the same period last year.

“Based on what has happened in the Town of Telluride, the continued decline of available inventory might start to slow the Telluride regional market around the end of summer. Available inventory is so low in Telluride and asking prices have gone up so much in the last 12 months that sales are slowing down significantly,” said Telluride-area REALTOR® George Harvey.

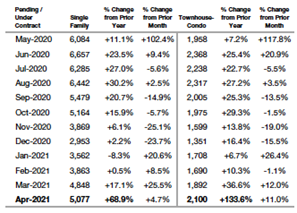

Percent of

List Price Received – Statewide

Percent of List Price Received – Seven-County Denver Metro Area

Median Sales

Price – Seven-County Denver Metro Area

Median Sales Price – Statewide

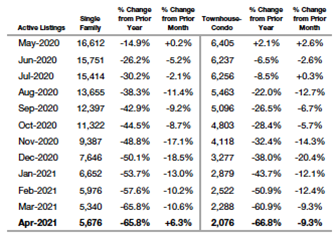

Inventory of Active Listings – Seven-County Denver Metro

Inventory of Active Listings – Statewide

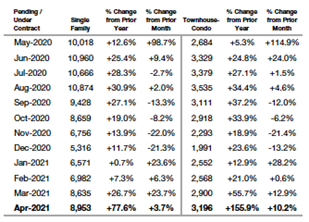

Pending/Under Contract – Statewide

Pending/Under Contract – Seven-County Denver Metro Area

The Colorado Association of

REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software

and market stats service provider to the residential real estate industry and

are based upon data provided by Multiple Listing Services (MLS) in Colorado. The

April 2021 reports represent all MLS-listed residential real estate

transactions in the state. The metrics

do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a

region’s housing is to its consumers, is based on interest rates, median sales

prices and median income by county.

The complete reports cited in

this press release, as well as county reports are available online at: http://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly

Market Statistical Reports are prepared by Showing Time, a

Minneapolis-based real estate technology company, and are based on data

provided by Multiple Listing Services (MLS) in Colorado. These reports represent

all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by

Owner” transactions or all new construction. Showing Time uses its

extensive resources and experience to scrub and validate the data before producing

these reports.

The benefits of using MLS data (rather than

Assessor Data or other sources) are:

- Accuracy and Timeliness – MLS data are managed and monitored carefully.

- Richness – MLS data can be segmented

- Comprehensiveness – No sampling is involved; all transactions are included.

- Oversight and Governance – MLS providers are accountable for the integrity of their systems.

- Trends and changes are reliable due to the large number of records used in each report.

- Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real

estate trade association representing more than 28,500 members statewide. The association

supports private property rights, equal housing opportunities and is the

“Voice of Real Estate” in Colorado.

For more information, visit .

This content was originally published here.