Secure Futures Colorado | SFC-One-Pager …

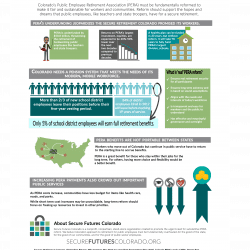

PERA Reform: Good for Our State, Communities, and Workers Colorado’s Public Employee Retirement Association (PERA) must be fundamentally reformed to make it fair and sustainable for workers and communities. Reform should support the hopes and dreams that public employees, like teachers and state troopers, have for a secure retirement. PERA’S UNDERFUNDING JEOPARDIZES THE SECURE RETIREMENT COLORADO PROMISED ITS WORKERS. Returns on PERA’s largest investment, equities, are expected to be 20%-50% lower over A healthy plan can be funded in 30 years, but without reform, it will take 78 years to fully fund PERA’s largest division, schools. PERA is underfunded by $50.8 billion, threatening the retirement of hardworking public employees like teachers and state troopers. the next two decades compared to previous decades. What is ‘real’ PERA reform? COLORADO NEEDS A PENSION SYSTEM THAT MEETS THE NEEDS OF ITS MODERN, MOBILE WORKFORCE. Ensures real retirement security for all participants Ensures long term solvency and is based on sound assumptions More than 2/3 of new school district Aligns with the needs and interests of today’s workforce 84% of district employees leave their positions before their five-year vesting period. employees hired in 2017 will leave before reaching 19 years of service. Is transparent and easy for members and the public to understand Has effective and meaningful governance and oversight Only 5% of school district employees will earn full retirement benefits. PERA BENEFITS ARE NOT PORTABLE BETWEEN STATES Workers who move out of Colorado but continue in public service have to return to the starting line to accrue benefits. PERA is a great benefit for those who stay within their jobs for the long term. For others, having more choice and flexibility would be a better benefit. INCREASING PERA PAYMENTS ALSO CROWD OUT IMPORTANT PUBLIC SERVICES As PERA costs increase, communities have less budget for items like health care, roads, and parks. While short term cost increases may be unavoidable, long-term reform should focus on freeing up resources to invest in other prioities. About Secure Futures Colorado Secure Futures Colorado is a nonprofit, nonpartisan, stand-alone organization created to promote the urgent need for substantive PERA reform. We belive Colorado’s approach to retirement for public employees must be fundamentally overhauled-for the good of the state, for the good of our communities, and for the good of public sector employees. SECUREFUTURESCOLORADO.ORG Sources: McKinsey & Company, Diminishing Returns: Why Investors May Need to Lower Their Expectations (May 2016), Colorado PERA’s yearly CAFRS, Denver Post, “PERA Finances Hit ‘Critical Juncture’ as Unfunded Liabilities Top $32 Billion,” (June 27, 2017), and Colorado Pension Project, PERA Member Profiles

This content was originally published here.